Understanding Tax Fairness and the Burden on Different Income Groups

The idea of giving a just amount in taxes has always been a topic for discussion, especially since the tax rules offer different benefits to people with varying income levels. Some persons give taxes purely based on their earnings, while others gain advantages from deductions, credits, and special treatment given to investment earnings. This leads to a situation where individuals having comparable incomes can have very different amounts payable in terms of tax. With the upcoming modifications in tax laws and a growing emphasis on creating revenue, it is more vital than ever before to grasp the impact of taxes as well as understand principles guiding fairness in taxation. This article will discuss how diverse taxpayers bear their responsibilities and whether our present system encourages fair allocation of taxes.

How the Tax Code Creates Disparities in Tax Burdens

The tax rules are designed to take care of different types of income, family situations, and business setups. While this can be viewed as sensible, it frequently leads to big differences in the amount of taxes paid by people with about the same earnings. One major cause for these unequal outcomes is that we favor investment income like capital gains and dividends which usually get taxed at smaller rates compared to paychecks or salary mc oney. Therefore, people earning a lot of money who get most of their income from investments can have lower effective tax rates than average-middle-income workers who depend totally on salaries.

In addition, tax deductions and credits are critical in forming the responsibilities of taxes. The Child Tax Credit (CTC) and Earned Income Tax Credit (EITC) lower tax debt for families having children, making sure that households with lower income get the required relief. Concurrently, deductions for interest on mortgages as well as state and local taxes mainly advantage those who own homes or have high earnings, increasing further the difference between varied group incomes. These provisions are complex because tax burdens usually depend not only on income levels but also on how this income is made and what deductions can be used.

Comparing Tax Burdens Across Income Levels

When we examine tax burdens in different income groups, it becomes clear that there are big differences in effective tax rates. People with lower incomes usually pay little to no federal income tax because of refundable credits, but they still give their share of payroll taxes, sales taxes, and property taxes. Those who earn medium incomes generally have a larger proportion of the total tax responsibilities as they might not be eligible for many deductions or credits while also having to pay payroll taxes at the same time. However, people earning the most money, even though they are subject to the highest formal tax rates, frequently find ways to reduce their total obligations by utilizing methods for effective tax management.

The Alternative Minimum Tax, also called AMT, was brought in to fix some of these differences. It makes sure that people with high incomes who get many deductions still pay a certain amount of tax at the least. However, the influence of AMT is not very big because many people making big money arrange their income so it affects them less. Similar gaps can be found at the corporate level which lets giant companies move profits globally or use benefits from deductions significantly reducing their taxes compared to what's legally required for corporations by the statutory tax rate.

The Impact of Tax Preferences on Revenue Collection

Tax likes, such as deductions and credits, they cause big revenue losses for the government. Studies say if we remove tax expenditures, it can make an extra $560 billion in revenue by 2026. But the problem is to decide which parts should stay to help economic and social objectives and which ones lead towards unwanted avoidance of taxes. For instance, if we take away the CTC and EITC, it would result in more tax burden on families with lower income. On the other hand, stopping deductions for business expenses or capital gains tax breaks will mainly impact people who earn high incomes.

These tax advantages also create horizontal inequality, where people earning the same amount of money end up paying different effective rates due to their capacity to claim certain deductions. This disparity is especially apparent among those who earn a lot, as they can structure their income as business profits instead of wages and thereby save impressively on taxes. The consequence is a system that seems progressive in theory but frequently permits individuals with resources to utilize lawful ways reducing their tax obligations notably.

Business Income and Tax Minimization Strategies

A very efficient manner to lessen tax liability is via business possession and alteration of income classification. Businessmen and owners can arrange their payment methods in such a manner that it decreases the rate of taxes, like earning through partnerships or S-corporations instead of conventional wages. This plan permits them to evade payroll taxes on some part of their profit and benefit from deductions which are not typically accessible for regular workers.

This income pass-through system, where the earnings of a business go directly to an individual's tax return, makes fairness in taxes more complex. It is designed to help small businesses but is used by many people with high incomes as a method to lower their taxes. Also, some kinds of business income are not subject to certain taxes like Net Investment Income Tax. This gives extra benefits to those who earn money from non-traditional salaries or wages.

How Wealth Preservation Strategies Affect Tax Liabilities

Rich people use different tax planning tools that help to greatly lessen their taxable earnings. A famous method is the "buy, borrow, die" tactic. Here, individuals get hold of assets that gain value over time and they take loans against these assets for managing expenses without causing any taxable income. They then hand over these assets to their offspring free from tax through the step-up in the basis rule. This method lets them amass considerable wealth with very low taxes, a big difference compared to what middle-income earners go through as their main source of income is wages which are heavily taxed.

Compensation which is postponed and choices of stock also add to differences in tax rate. Managers commonly get large parts of their income as stock instead of direct earnings, permitting them to delay taxes until the time stocks are sold, frequently at lesser rates for capital gains. These benefits establish a setup where salaried money gets higher taxation in comparison to income from an investment basis; this promotes disparity in earnings between different groups.

The Role of Corporate Taxes in Overall Tax Contributions

Taxation on companies also influences the complete fairness of the tax system. Corporations are under a flat statutory tax rate, but they usually make use of deductions, credits, and international strategies related to taxes to lessen their effective tax rate. This outcome results in major differences in the amount of taxes paid by varying businesses; typically larger multinational businesses tend to pay less as a portion of profits than smaller ones.

Discussion about company tax goes further than just fairness, it involves economic effects. On one hand, less business taxes can support investment and creation of jobs but on the other hand, they lower government income which results in individual taxpayers having to bear more load. Suggestions for raising corporate tax rates or closing loopholes have caused debates on whether companies should be asked to add more to the overall taxation especially when there is a rise in government expenditure.

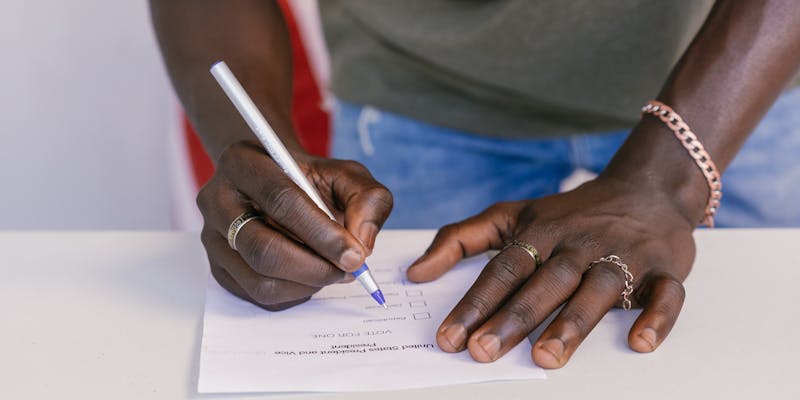

So, Do You Pay Your Fair Share of Taxes?

Whether a person pays a fair amount of taxes relies on many factors like how much they earn, what deductions apply to them, and the loopholes in tax law that currently exist. The idea of fairness when it comes to paying taxes is subjective, as people's views and discussions about policy shape this perception. Some people think those who make more money should give more towards public revenue whereas others hold that lower tax rates stimulate economic advancement. Tax adherence also has an important part, because assertive tax avoidance methods might lawfully lessen payment but can bring up ethical problems. In the end, giving a fair amount of tax is not only about obeying the rules but also thinking about the wider effects that your taxes could have on society too.